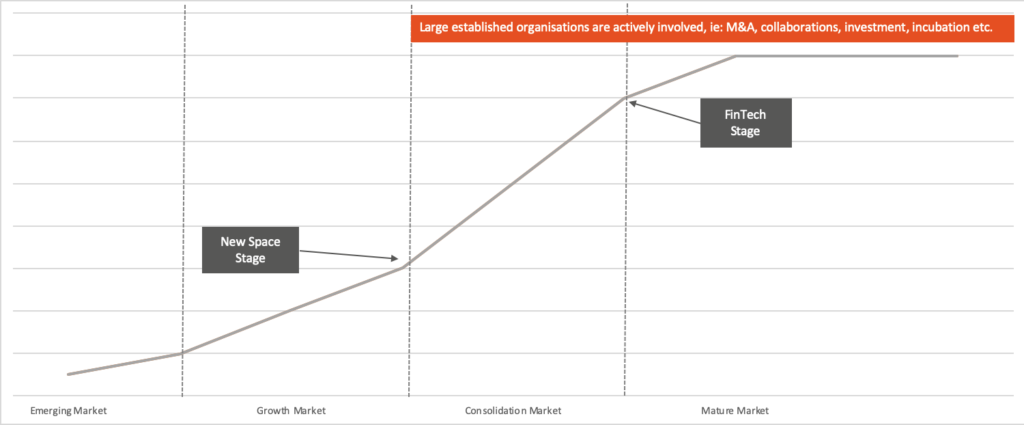

The New Space market is at a tipping point. This is as much an opportunity as it is a warning to both start-ups and incumbents in the space industry. This article looks to the immediate future of New Space, drawing parallels from the digital economy, in particular the growth of FinTech. New Space is entering a consolidation phase has seen rapid growth with the emergence of new companies. This ‘Consolidation Market’ is where there is much greater collaboration across the industry including merger and acquisition activity as we saw with FinTech who are now moving toward a mature market state:

The key example of this tipping point toward a consolidated market is seen in satellite applications. This sector is flooded with a diverse range of new start-ups providing data storage, management, qualification and insight for clients in the defence, insurance, finance, agriculture, government and more. Uniquely they are bringing new business models, low pricing structures (thanks to the digital capability in place and low overheads) and highly targeted customer solutions, with customer insight available like never before. This is the ‘Growth Market’ which is challenging incumbent companies and accelerating value-add to customers.

However, downstream satellite applications are reaching a tipping point, in the same way, FinTech companies did from about 2010. Regulations in the banking industry were a significant limitation to these start-ups scaling. In addition, the start-up market was flooded with more and more competition so making it a challenge to secure those essential customers from a depleted pool of interested buyers. Innovation became iteration and replication in a different package, and focus shifted from company growth to company buy-out. Large established companies like Barclays started to set up innovation and incubation divisions to invest and acquire the hottest options on the FinTech market.

This resulted in the consolidation of the industry, where early market leaders like Nutmeg and Metro Bank emerged with more investment, and others got absorbed into larger companies who had the budget and skills to deal with regulation and system integration. This is the ‘Consolidation Market’

Consolidation in New Space is just beginning, with incumbents showing interest in mergers and acquisitions alongside focused private investment funds. As well as Prime’s looking to their SME strategy to define collaborations. This trend was also highlighted by Seraphim Capital in their Space Predictions 2019 “Let the 2019 Consolidation Games Begin!”[i].

The start-ups that survive are the ones that are prepared to mature from a start-up to a scale-up. Shifting from R&D tech-led to consumer-led organisations. This also means a willingness to collaborate and even be acquired to overcome the barriers to truly scale in capital intensive, regulatory heavy industry.

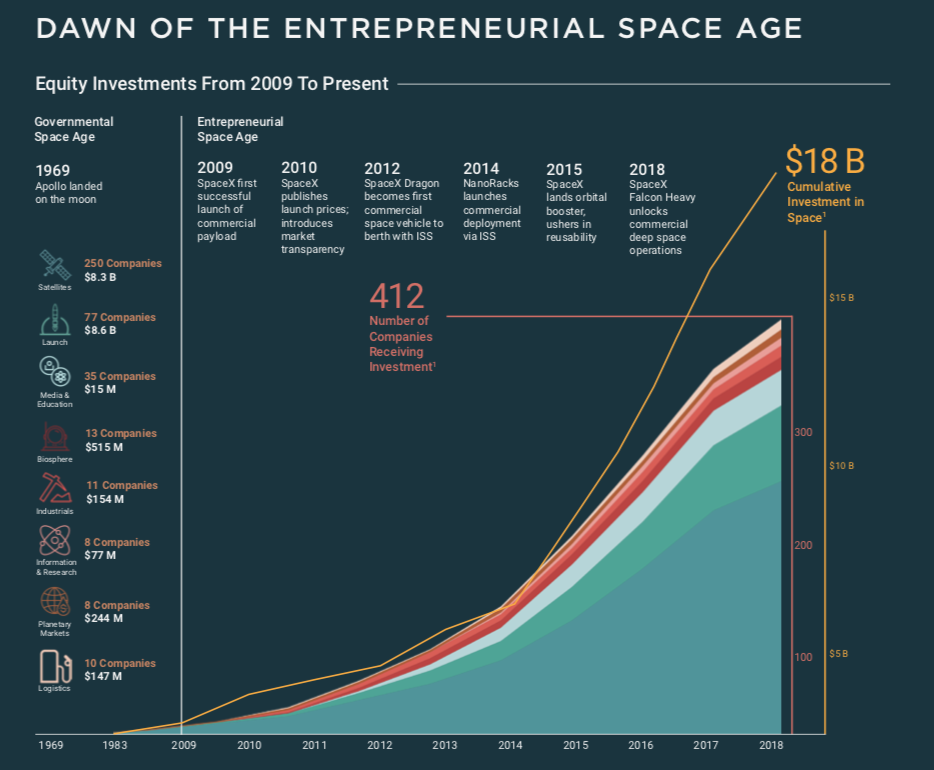

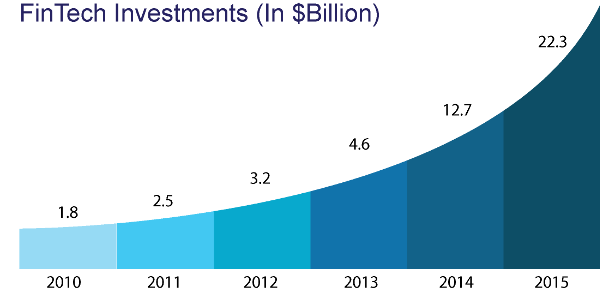

Consolidation is important as it stimulates further investment and subsequent industry growth. Today the space industry is seeing growth in private investment (Cumulative $18bn in the past 10 years) as it starts to consolidate. Yet, when we look at the mature FinTech market we see a quantum leap in volumes and values (cumulative $47.1bn in the 5 years from 2010 to 2015) to that of the space industry.

So, what has enabled this tipping point toward a consolidation market? As with FinTech there are three key enablers:

| NEW SPACE | FINTECH |

| Capability | |

| Improved performance, faster to market at lower costs (new material technology, manufacturing methods, etc.) | Improved performance in smaller packages at lower costs (processing power, mobile phones, etc.) |

| Accessibility | |

| Collaboration through government and industry to standardize approach and provide infrastructure and tools for companies. | The internet provided accessibility from dial-up to broadband and 5G, enabling anyone to connect, share, create, build, sell and learn from anywhere in the world. |

| Sharing Economy – A Cultural Shift | |

| Dedicated agencies and funding supporting knowledge share, collaboration, and technology transfer. Online resources, knowledge and tools (i.e. Google CAD) are key to this. | As the worldwide web matured non-technical music creators, content producers and website builders emerged who did not have to be coders. Knowledge and tools were made available for free online. |

As New Space begins to consolidate, it is less about ownership and more about providing the means for serious players to emerge as leaders and forerunners in their field, further stimulating growth and investment opportunities

AUTHOR: Natasha Allden, Founder and CEO of MULTIPLY Global Ltd.

MULTIPLY is the only agency in the UK focused on commercializing space technology. Unleashing the potential for SME’s to scale and large organizations to mitigate disruption and innovate. Established in 2015 MULTIPLY has developed opportunities in excess of £20m for their clients from public grants, private financing, technology transfer, new markets and collaborations. MULTIPLY defines, designs and delivers strategies, propositions through end-to-end customer programmes for clients globally.

www.multiply.space

[i] http://seraphimcapital.passle.net/post/102fd5w/seraphim-space-predictions-2019>

[ii] https://spacenews.com/space-startup-investments-continued-to-rise-in-2018/

[iii] https://www.whatech.com/market-research/financial-services/archive/465694-fintech-investment-market-growth-opportunity-and-industry-forecast-to-2023-illuminated-by-new-report